1-min read

I was talking to a friend, and realized:

‘Florida law does NOT require homeowners insurance but your mortgage company may. If you fail to maintain your insurance, the lender has the right to obtain and place coverage on your property via a “forced-placed” policy and then charge you in addition to your loan premiums.’

*

‘This forced placed insurance is VERY expensive and should never be maintained if it can be avoided by a homeowner in Florida. In any event, you are strongly recommended to carry insurance to protect your property investment.’

Back of the envelope thoughts and calculations:

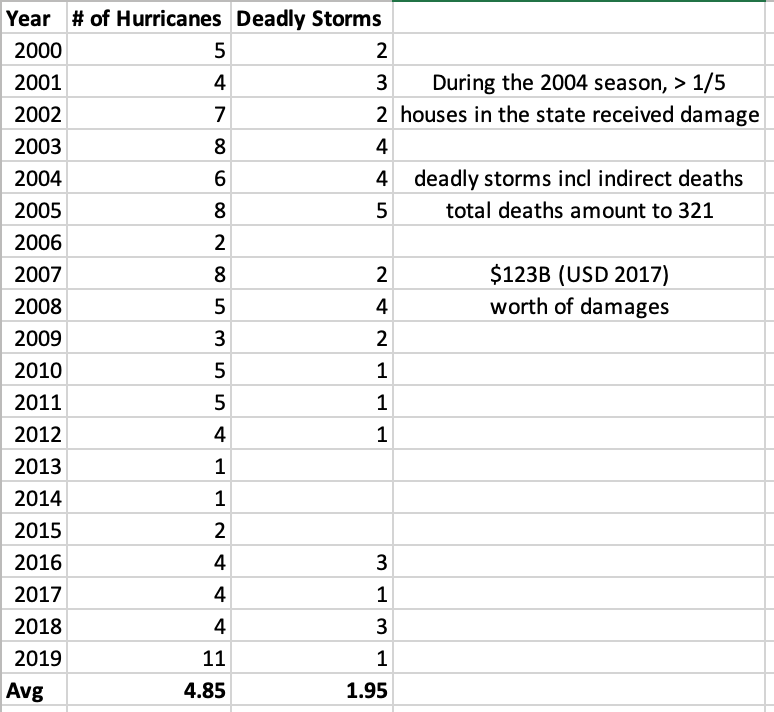

Between 2002-19 there were ~4,85 hurricanes a yr

But only ~2 were 'deadly' — Irma caused 41% of total damages

Reverse Engineering insurance calculations (prob a mix of age, sq. ft, location)

This might seem resource-intensive + expensive BUT

Pricing premiums lower than Allstate, liberty, met, the state will capture entire states (?) housing/ flooding insurance especially in Florida is ripe for disruption disclaimer: leave NW/ SW/ SE Florida alone and capture neighborhood-level

Kin is currently the only insur-tech startups in Florida with lemonade, hippo not providing any service as of now

Insurers get to invest this float, which essentially acts as a glorified hedge fund with multiple shareholders - max decline in the float at the outside will be no more than 3% in any year barring extraneous circumstances