7-min read

This content is for informational purposes only. You should not construe any such material herein as legal, tax, investment, financial, or other advice.

It has been a while since I shorted a stock, especially one concerning a biopharmaceutical company. Having been burnt multiple times — either by timing it incorrectly or the stock inverting hard facts — my trading philosophy has changed somewhat from high-risk high-return yield to a more ‘balanced’ approach. But after happening on their headlines, I couldn't resist.

The Good

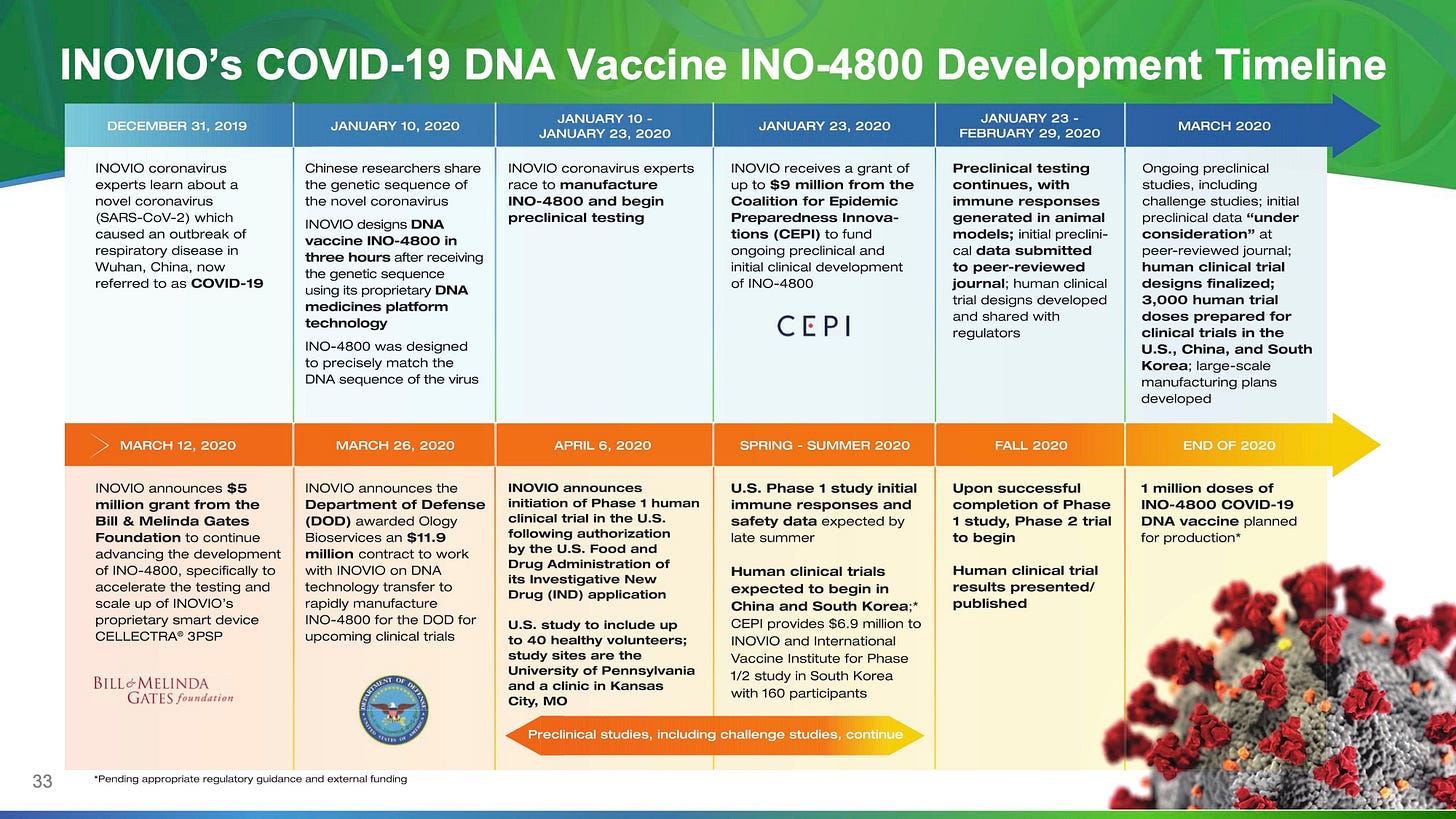

On the 6th of April 2020, Inovio Pharmaceuticals Inc, trading as $INO, announced they were running clinical trials for a coronavirus vaccine. A quick look at their 8-K resulted in my affirmation in regards to corporate mismanagement and a scandal in the making.

has received approval from the U.S. Food and Drug Administration (the ‘FDA’) to proceed with a Phase 1 clinical trial of its DNA vaccine candidate INO-4800, designed to prevent COVID-19 infection.

With their CEO churning degrees from Wharton and UPenn, you’d expect INO to have foresight in the delicate nature of clinical trials. But alas, investors suffer the consequences of a company that hasn’t brought a single product to market since inception — 36 years of abject failure. More research connected the dots:

Phase 1 clinical trials are inherently worthless — they’re testing on healthy humans, running through a check-list to determine if a vaccination meets the safety standards, has any side effects, and what would be the appropriate dosage. It doesn’t even matter if the drug works — which is what Phase 2 needles out. This isn’t news. Also — sponsors have to apply before implementing a trial — unnecessarily padding their relations brochure with FDA is akin to resume stuffing.

The Bad

With a history of deceit, you’d want to be careful with what Joseph Kim has to say.

On Zika, from CNBC:

Inovio also has an Ebola vaccine in the pipeline and is competing against the likes of Merck, Johnson & Johnson, and GlaxoSmithKline. However, Kim is confident his company can take on its larger rivals.

Unfortunately, this isn’t a David & Goliath epic, and this is not their first rodeo. This share-price spike is cognate of their perceived ability to derail retail investors for a short-term gain intentionally.

It’s challenging to predict earnings for biopharma companies, and even with six analysts on top of INO, it’s mostly a hit and a miss. After scrubbing through hundreds of companies in my post ‘Estimated v. Reported Earnings Per Share’ — I understand these challenges.

GILD’s Estimated Earnings Per Share of 1.67, landing at reported EPS of 1.3 with a Surprise Percentage of -22.16%. The only consistent performance INO has brought to the table is regularly disappointing their shareholders, bar two insignificant anomalies.

From a media perspective, Cramer is a good indicator of stock tops, once he starts mentioning a particular ticker, it jumps for retail investors and then bottoms out. The same goes for Trump — calling on biopharma companies to quicken their pace. The supposed ‘Bill & Melinda Gates Foundation’ donation of ~$5MM is via The Wistar Institute, which has close ties to UPenn (CEO’s alma mater). A few million is a drop in the bucket compared to the $483MM grant Maderna received from BARDA.

I wanted to look at this purely from a statistical perspective, and data don't lie unless you want it to. With Gilead and Maderna having 11,800 and 830 full-time employees, respectively, you have to wonder how a 190-strong company can fast-track and design a vaccine in 3 hours. These irregularities keep adding up.

From their March 12 10-K,

The number of shares outstanding of the Registrant’s Common Stock, $0.001 par value, was 145,803,086

The sudden influx of interest in a vaccine has propelled INO along with others, namely Vir Biotechnology) to all-time highs — 248.84% and 145.27% YTD. Even a dated article from The Motley Fool would instead choose $VIR:

This choice is based on Vir's seemingly stronger financial position: At the end of the third quarter, the company had $320.2MM in cash, cash equivalents, and short-term investments. Vir's balance sheet showed about $22.5MM in long-term liabilities at the end of the third quarter, and the company recorded a revenue of $1.4MM for the quarter. By contrast, Inovio's revenue for the third quarter was $867,000. The company had $93.8MM in cash, cash equivalents, and short-term investments as of Sept. 30, 2019. Lastly, Inovio had $95.9MM in long-term liabilities during the third quarter.

Now I am probably naive enough to invest in a company that has my hypocorism in it, but at least I won’t choose a stock which is bleeding.

Final Thoughts? Their risk factors point towards a predictable and impending doom:

We have incurred losses since inception, expect to incur significant net losses in the foreseeable future and may never become profitable.

None of our human vaccine and immunotherapy product candidates have been approved for sale, and we may not develop commercially successful vaccine products.

And that is why I have a short position on them for their 37th company anniversary. I am excited for their upcoming earnings call on May 11.

Along with the green light from Andrew Left, I knew I was in good hands. I was ready to hold this until the end of time.

The by-product? A target price of $1.

The Ugly

Nothing to add here — would instead quote the multiple ensuing lawsuits:

The Klein Law Firm announces that a class action complaint has been filed on behalf of shareholders of Inovio Pharmaceuticals, Inc. (NASDAQ: INO) who purchased shares between February 14, 2020, and March 9, 2020. The action, which was filed in the United States District Court for the Eastern District of Pennsylvania, alleges that the Company violated federal securities laws.

In particular, the Inovio lawsuit alleges that defendants made misleading statements about the company’s development of a purported vaccine for the novel coronavirus, artificially inflating the company’s share price and resulting in significant investor losses.

Among the lawyers and firms seeking investors for a possible suit were Glancy, Prongay & Murray; Howard G. Smith'; Bronstein, Gewirtz & Grossman; and the Pomerantz Law Firm.

I’m going to end on a section from Buffet’s 1986 letter to shareholders:

What we do know, however, is that occasional outbreaks of those two super-contagious diseases, fear and greed, will forever occur in the investment community. The timing of these epidemics will be unpredictable. And the market aberrations produced by them will be equally unpredictable, both as to duration and degree. Therefore, we never try to anticipate the arrival or departure of either disease. Our goal is more modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.

Post Mortem Update

$INO had its earnings call on May 11, 2020, during after hours.

TL;DR? They missed their EPS by 9.47%, where expected was -0.24 and they managed to scrounge it up to -0.26. The expected revenue was 1.91MM, reported was 1.33MM, with a beautiful surprise percentage of -30.60%.

The entire day the stock rallied, gaining as much 665bps. After hours was a blood bath, with the stock losing all momentum, slipping to $11.35.

I’d also like to take a moment to thank these analysts for their buy signal:

Cantor Fitzgerald analyst Charles Duncan reiterated an Overweight rating on Inovio and increased the price target from $13 to $17.

H.C. Wainwright analyst Raghuram Selvaraju reiterated a Buy rating and hiked the price target from $13 to $17.

With no commercial product in its stable, the company generates revenue from licensing, grant funding, and interest income.

Keynotes from the earnings call (or reading between the lines):

we expect to have preliminary safety and immunogenicity data by late June in support of advancing rapidly to our Phase 2, 3 efficacy trial, which is planned to potentially initiate in the July, August time frame

More time for them to sell their shares on the open market.

As communicated earlier, the company expects to start the Phase 2/3 efficacy trial in summer, contingent upon regulatory approval.

Which they will not be receiving.

our DNA vaccines do not require the challenging deep-frozen coaching storage. In fact, our vaccines are stable at room temperature for at least one year and five years at two-degrees to eight-degrees Celsius, which of course, is normal refrigeration temperature

Your concoction can remain stable anywhere when it doesn’t do anything.

The negative reaction may have to do with the first-quarter miss and a lack of significant incremental updates on its INO-4800 vaccine program.

Tidbits from Q&A:

Naureen Quibria — Maxim Group, Analyst

You know you mentioned that survival data for one-year for these patients are historically 60% to 65% at one year, are you able to share with us what kind of delta you hope to see from historical rates for the 12 months OS? What would you think would be encouraging?

J. Joseph Kim, Ph.D. — INO, President, Chief Executive Officer, Director

Well, what number would get you excited Naureen?

Naureen Quibria

Obviously, well higher than that.

*

Jonathan Aschoff — ROTH Capital, Analyst

Joe, if it was a BLA, how much you think it would cost for that process, including a million doses?

J. Joseph Kim, Ph.D.

So potentially, our next trial could be a registrational trial, Phase 2/3. If we assume that and we assume a million doses, I mean that will be in a total value of $100 million 150 million from the start.

Jonathan Aschoff

Okay.

J. Joseph Kim, Ph.D.

Is that what you're looking for or...?

Nothing has changed; I’m still short.